Third Quarter 2024

Quarterly Comments September 30, 2024

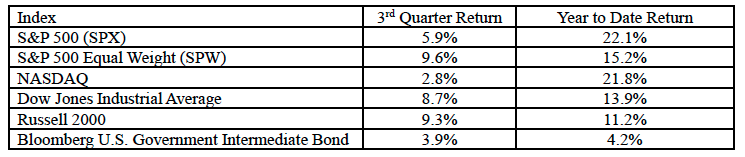

A resilient economy, further progress on inflation, and the Federal Reserve’s decision to reduce interest rates by 50 basis points all contributed to solid third-quarter equity and fixed income returns. Despite major economic events in the last three months, equity markets finished mostly higher in the third quarter, as seen in the table below. Fixed income markets participated in the rally, spurred on by the Fed kicking off its most recent rate cutting cycle two weeks ago. In this edition of the Market Comments, we analyze the economy, equity valuations, and the bond market.

Markets Performance

Economy

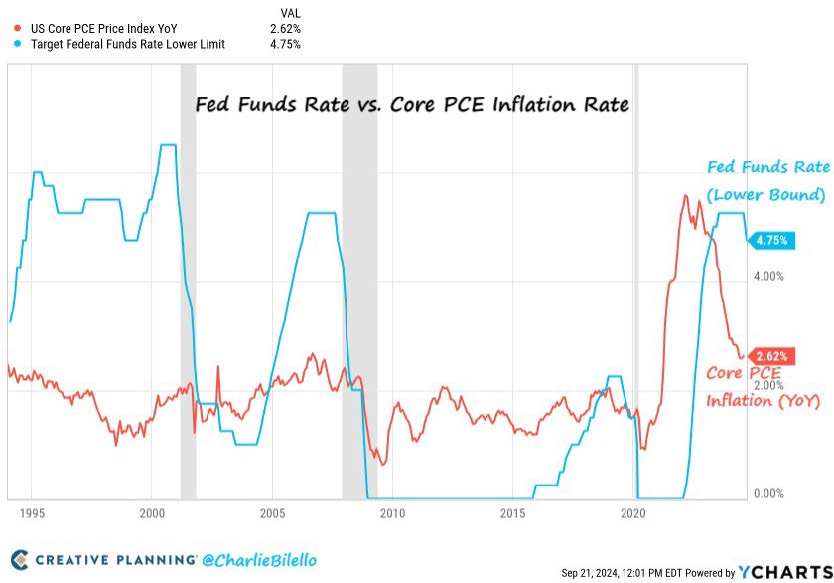

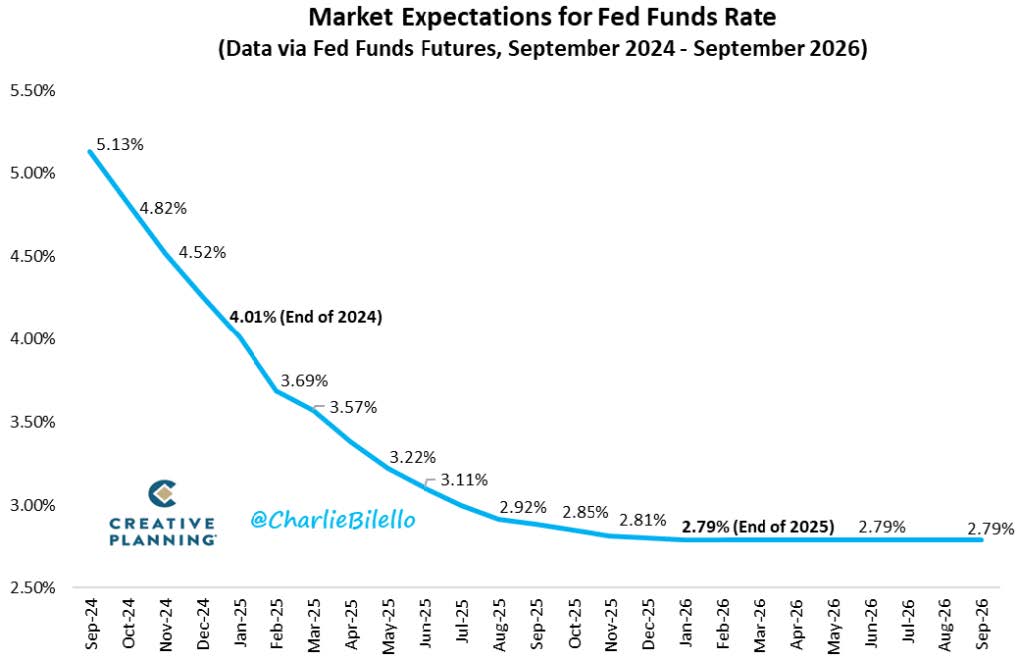

Inflation has moderated to a more comfortable range with the Core Consumer Price Index (Core CPI) up 2.5% and Core Personal Consumption Expenditures (Core PCE) up 2.7% in August 2024. As observed by the Fed, these numbers are still above the stated target of a 2% year-over-year increase, but significant progress has been achieved on the inflation front compared to the peak 9.1% CPI increase in June 2022. With inflation moderating, the Fed reduced the federal funds rate by 50 basis points on September 18th. Following the September reduction, the Fed’s Summary of Economic Projections (SEP) showed an additional 50 basis point reduction by the end of 2024 and another 100 basis points in 2025. Of course, continued easing is predicated on the ability of the Fed to “thread the needle” in achieving both lower inflation and an economic soft landing, the probability of which is debatable.

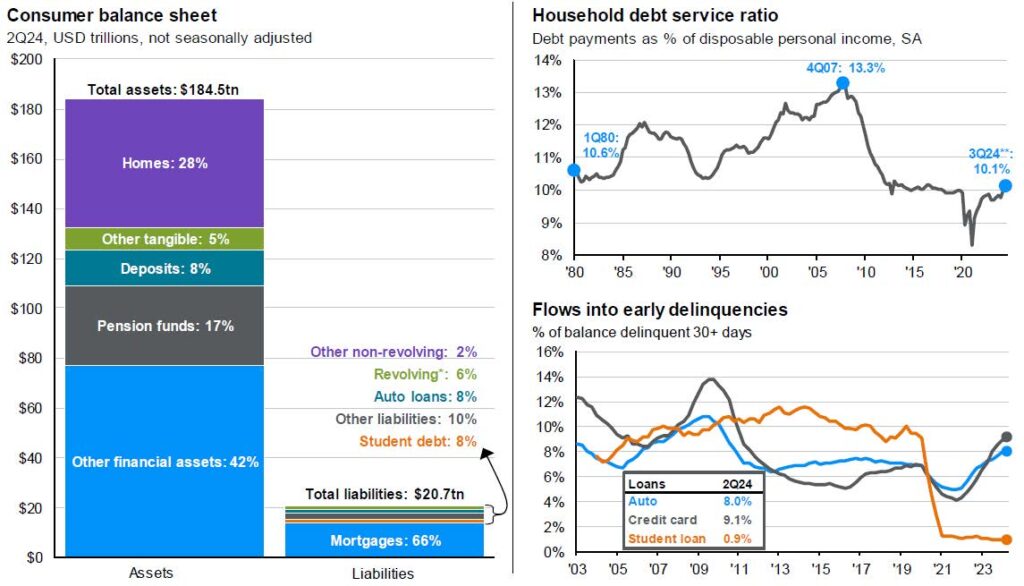

There are some positive indications that the economy may be able to balance slower economic growth and lower inflation. Real Gross Domestic Product has maintained healthy growth in 2024 with an approximately 2.2% gain in the first half and a current estimate from the Atlanta Fed of third quarter growth at 3.1%. Over 70% of GDP is driven by consumer spending and real wage growth has been positive for 16 consecutive months. However, there are concerns that the lower-income consumer is under pressure. Spending patterns have continued a shift toward non-discretionary items as consumers have less discretionary income for travel, autos, and consumer electronics. Inflation has eroded buying power and the pandemic stimulus payments have run out. Trouble has appeared in consumer debt with credit card delinquencies at a decade-high 9.1% and auto loan delinquencies at a 14-year high of 8%. Ultimately, consumer stress has pushed the average individual savings rate down to 3.4% in contrast to the long run average of nearly 6%. Already wary consumers are in a job market that, while still at relatively low unemployment, has seen that metric rise to a multi-year high of 4.2% alongside slowing job additions and less availability of open positions. At its September meeting, the Fed made it clear that they are turning focus to the labor market, reestablishing the dual mandate after its quite singular focus on inflation since 2021.

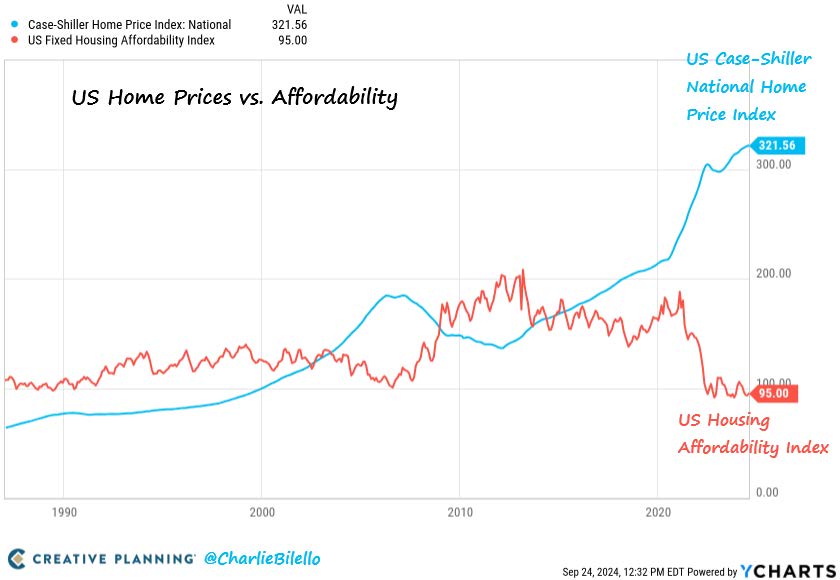

Troubling signs can also be seen in other areas of the economy. Weakness continues in the manufacturing sector, where the ISM’s Manufacturing Purchasing Manager’s Index (PMI) has indicated contraction in 21 of the last 22 months. Additionally, a stagnant housing market shows little sign of restarting with pricing gains and unaffordability still stubbornly high. Lastly, U.S. national debt surpassed $35 trillion, with the interest cost to service the borrowings already greater than the Defense Department budget. As a larger share of the Federal budget goes towards servicing debt, fewer resources are available for investments in infrastructure and technology research and development, a fact that could ultimately constrain economic growth. The economy is performing well now but with the existing cautionary indications, more weakening in the labor market could lead us into a downturn.

Equities

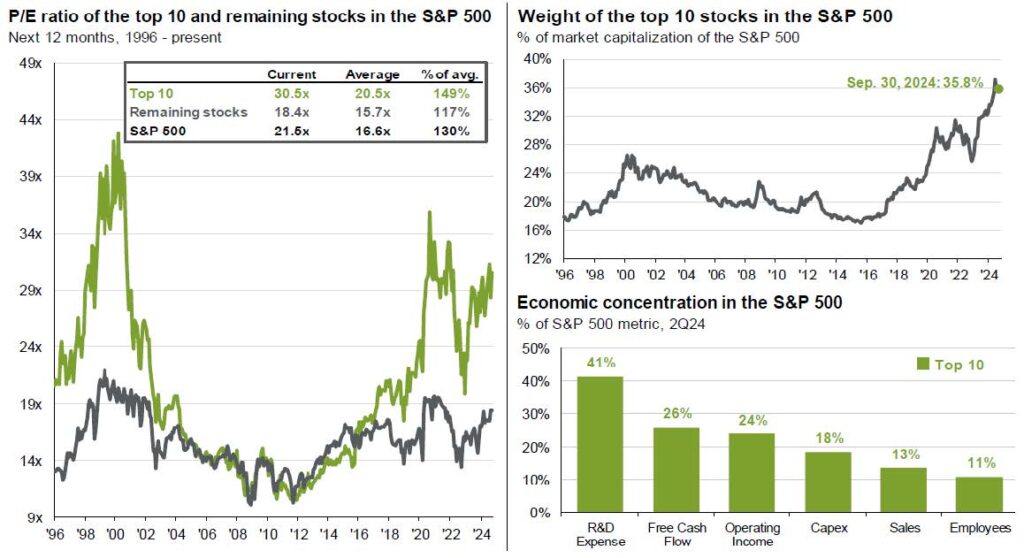

Equity markets continued their 2024 gains in the third quarter, though in a different manner than the previous 20 months. The S&P 500 equal weight index (SPW) outperformed the return of the market cap-weighted index (SPX) in the quarter, indicating a broadening in market performance that had been all but absent in 2023 and 2024. In anticipation of and following interest rate cuts, the top performing sectors on the quarter were Utilities (+19.4%) and Real Estate (+17.1%). While some of those returns are attributed to investors looking to higher dividend-yielding areas as rates come down, part of this is attributable to a rotation into historically defensive sectors as the economic outlook becomes less certain. Utilities are benefitting from changing dynamics around power consumption in support of Artificial Intelligence (AI). The growth in AI datacenters is a primary driver behind forecasted U.S. power demand growth of almost 40% by 2040. What were once boring, dividend-paying stocks have become growth stories, especially if the companies have nuclear generation capabilities. Those with nuclear assets have recently commanded premium valuations as investors price in long-term datacenter supply contracts. On the other side, Technology (0%) and Communications Services (+5.9%) were some of the worst performing sectors in the quarter as questions emerged around monetization of AI and the potential returns on AI capital expenditures.

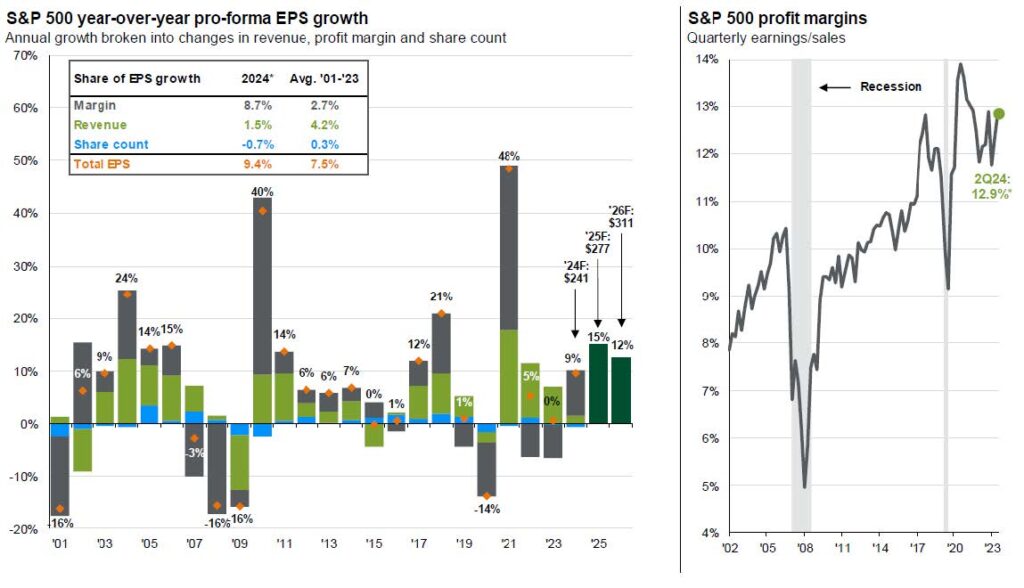

Despite some healthy broadening in equity performance, observations in recent quarters of market concentration still hold true with the largest companies in the S&P 500 driving most of the return on the year and the SPX outpacing the SPW by nearly 7%. We view the market’s recent broadening positively but see upside limitations on corporate margin performance in the near term. SPX second quarter net margins came in above 12%, showing the effect of years of corporate pricing power. With the consumer weary of higher prices, consumer staples and discretionary companies have shifted their focus to value, including discounts and promotions in order to retain market share. In addition, while the trend in reshoring manufacturing capacity to the U.S. benefits American labor, it would likely pressure margins through increased labor costs. If pricing power has indeed abated and margins have peaked, the already stretched valuations of the SPX look even more elevated given potentially lower earnings growth going forward. The SPX, trading at just over 21 times its forward earnings versus its long-term average of 17, could see returns moderate from 10-12% gains per year on average to the 5-7% range absent other positive catalysts.

Fixed Income

In anticipation of the Fed cutting interest rates, bonds rallied in the third quarter. Monetary policy-sensitive 2-year Treasury yields fell 112 basis points in the quarter, from 4.76% to 3.64%. Further out the yield curve, 10-year Treasury yields fell as well, dropping 68 basis points from 4.46% to 3.78%. Short-end yields falling further than long-end yields ended the record 50-month inversion of the 2-10 year yield curve.

Historically, the dis-inversion of the yield curve (short rates falling below long-term rates) has been an indicator of an imminent economic downturn as the Fed was responding to weak economic conditions. As discussed in these comments, lower inflation levels, relatively low unemployment, and moderate GDP growth mean that this round of Fed cuts is not in response to currently poor economic conditions. Rather it is an attempt to ease monetary policy before economic conditions deteriorate significantly enough to induce a recession and drive up unemployment: a.k.a. engineering a soft-landing. The soft-landing narrative seems to have been fully embraced by equity markets and is reflected in credit markets as well. Credit spreads in both investment grade and high yield bond markets, as well as the spread between investment grade and high yield debt, are at multi-year lows, indicating strong demand for fixed income and that investors are not demanding much premium for the added risk of lower-quality balance sheets. Issuers have responded to falling rates and historically tight spreads, with the third quarter seeing record corporate bond issuance and robust new issue municipal supply.

Fixed income continues to be an attractive option for investors looking for ballast, income, and liquidity in uncertain economic times. Even with the move down in interest rates, real returns on investment grade credit still exceed 2%. Given lower benchmark rates, tight spreads, and potential concerns about the future state of the U.S. consumer, we are being somewhat more selective on credit and more cautious on extending maturities when deploying incremental capital than the previous eighteen months. We continue to build laddered bond portfolios with durations of 5-6 years to mitigate interest rate risk and provide flexibility to clients.

Summary

The third quarter saw healthy broadening in equity markets with the SPX and SPW up 5.9% and 9.5%, respectively. Credit demand and issuance remained strong in a moderating growth economy as investors price in significant optimism. Looking forward, we will be cautiously monitoring consumer health and national economic indicators in the pursuit of a soft landing, which has only been achieved once in the preceding four decades (1994-95). We maintain our focused approach on managing diversified portfolios that enable clients to capture upside while limiting downside risk in difficult economic environments.

Inflation has been coming down and Fed Funds Rate will likely continue to fall

Market already pricing-in steep rate cuts, a risk if Fed does not deliver

Housing affordability continues to be an issue

Consumer finances

S&P 500 Index concentration and valuation

Earnings growth and profit margins

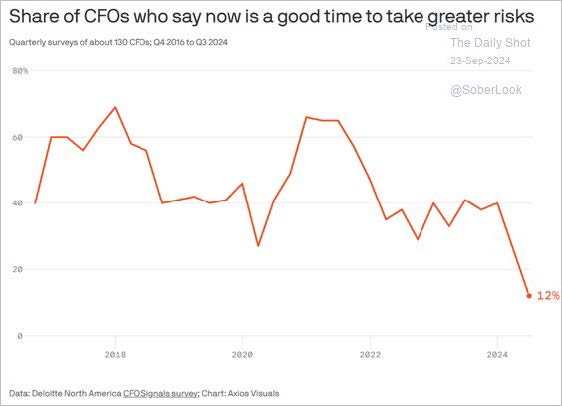

Companies are turning more cautious