First Quarter 2024

Quarterly Comments March 31, 2024

Equity markets rallied to all-time highs during the first quarter of 2024. The S&P 500 returned 10.6%, the Dow rose 6.1% and the Russell 2000 increased 5.2%. A resilient economy, strong technology sector returns driven by robust artificial intelligence investment, and the expectation of lower interest rates in the second half of 2024 all contributed to the favorable first-quarter returns. After a year of positive, though volatile returns in 2023, bonds got off to a sluggish start in 2024 with the 10-year U.S. Treasury yield rising 38 basis points to 4.24% from 3.86% at the end of 2023 (yields up/price down).

Economy

The United States’ economy entered 2024 on solid footing. Real Gross Domestic Product (real GDP) grew 2.5% in 2023, including 3.4% year over year in the fourth quarter, attributable to persistent consumer spending and fiscal spending programs. Data also suggests there was progress made in reducing inflation with the Personal Consumption Expenditures (PCE) declining to 2.6% in December 2023 from 5% a year ago and closer to the Fed’s 2.0% target. Normally, these metrics move in the same direction where higher economic growth leads to a path for higher inflation. However, global supply chains have largely recovered from Covid disruptions and combined with a strong rebound in labor force participation (workers returning from Covid sabbaticals along with influx of migrant laborers), the U.S. economy has expanded faster than expected without putting significant upward pressure on wages or inflation.

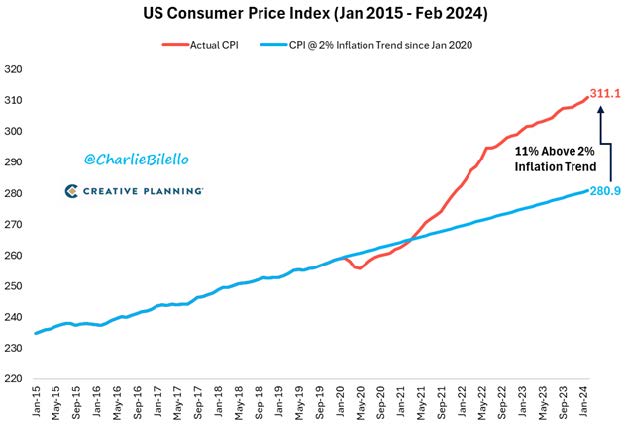

Recent data suggests it could be a challenge hitting the Fed’s 2.0% PCE target despite making progress on inflation. The Consumer Price Index (CPI) rose a higher-than-forecast 3.1% and 3.2% in January and February, respectively, due to higher shelter and gasoline prices. Federal Reserve Chair Powell remarked at the March Fed meeting that despite the higher-than-expected CPI data, the latest information “has not really changed the overall story, which is that inflation is moving down gradually on a sometimes-bumpy road to 2%. We are not going to overreact to these two months of data, nor are we going to ignore them.” These dovish remarks appeared to investors to reaffirm the projection of three interest rates cuts in 2024 and led to a stock rally towards the end of the quarter that resulted in an all-time-record high for the S&P 500.

We have a different view than the market and are not convinced that three rate cuts are inevitable. In the week following the Fed meeting, two Fed voting members walked back Mr. Powell’s dovish commentary, arguing for fewer rate cuts given the stronger than expected economic data. There is division within the Fed, with nine believing two or fewer cuts are appropriate this year while the remaining ten are looking for three cuts. The most recent PCE data point rose 2.5% year-over-year and in line with expectations. Chairman Powell was less sanguine in his comments following the PCE release, saying it would not be appropriate to lower rates until they’re confident inflation is on track towards its 2% goal and the Fed will remain cautious and data dependent. There are two risks as the Fed tries to balance economic growth and inflation. The first is that they ease too quickly, allowing inflation to become entrenched at a level above 2%. The other is that they move too slowly and the economy stalls under the weight of higher rates.

A factor behind the economy’s healthy growth has been the unprecedented fiscal spending that is still moving through the system. Partly due to the pandemic, the federal government incurred deficits of $3.1 trillion in 2020, $2.8 trillion in 2021, $1.4 trillion in 2022 and a forecasted $1.5 trillion for 2023. These are extraordinary numbers that ended up in the pockets of consumers, state and local governments, and companies large and small. It is not terribly difficult to grow the economy when the government is handing out money. Looking ahead, the Congressional Budget Office estimates a deficit of $1.6 trillion for 2024 with no end of deficit spending in sight. While politicians are not focused on these growing deficits today, the U.S. will need to address the issue eventually and the solutions are unlikely to be friendly for the economy or the market.

Equities

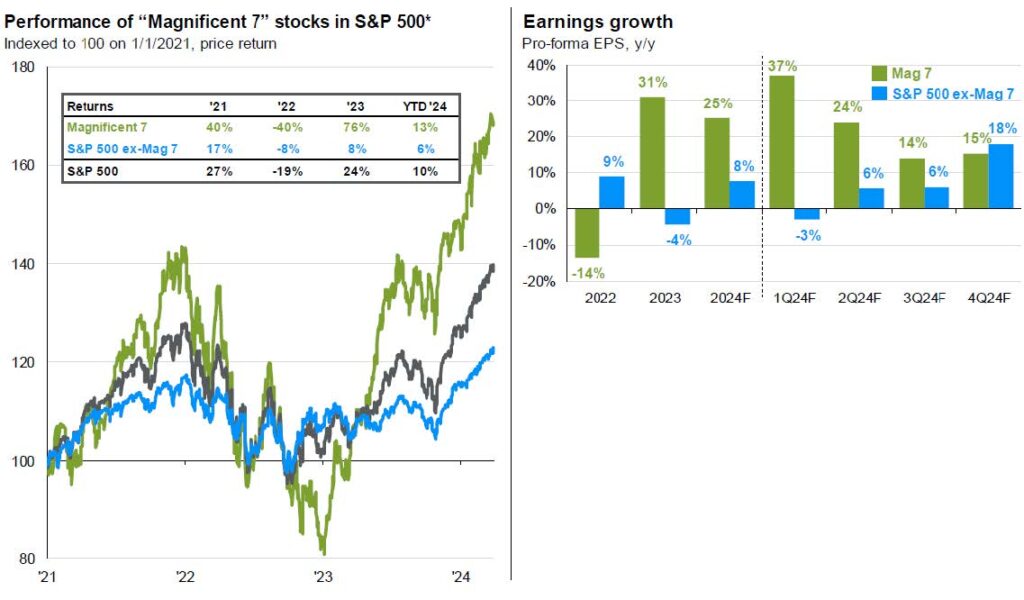

Following the 26.3% return in 2023, stocks continued their march higher with the S&P 500 advancing 10.6% in the 2024 first quarter. Whereas the prior year’s performance was dependent on just a handful of technology stocks (the Magnificent 7 accounted for 76% of 2023’s increase), the 2024 improvement has been more broad-based, with 10 of 11 sectors recording positive performance. While technology and communication services stocks again posted the strongest returns, other sectors including Financials, Industrials and Energy also experienced above market-average performance. Other metrics that suggest wider market participation include greater than half the companies in the S&P 500 reached new highs this quarter and more than 80% of the S&P 500 are trading above their 200 day-moving average. Broader participation usually indicates a healthier market.

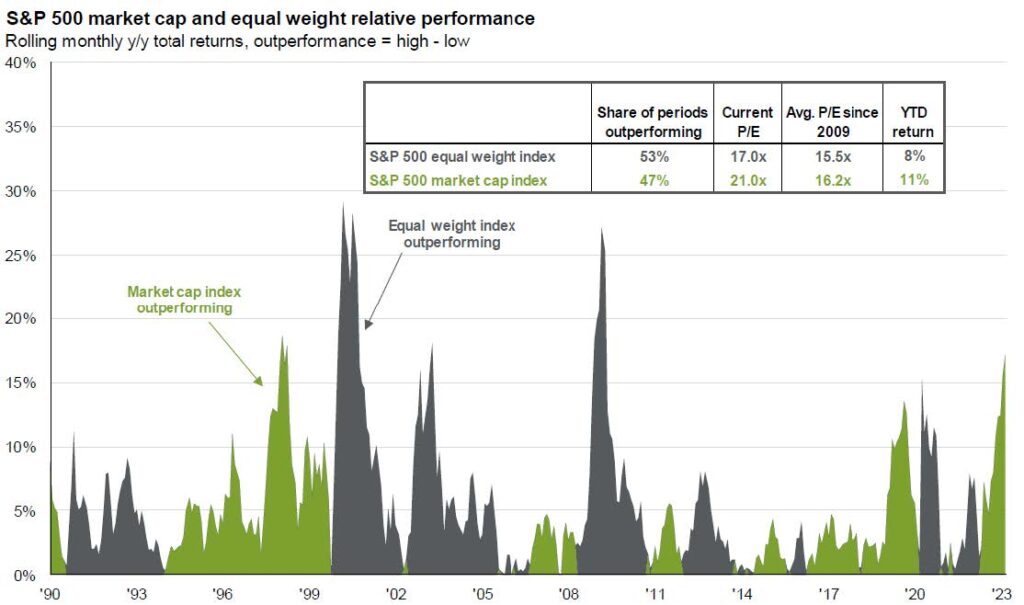

Given the strong market performance, we believe larger cap stocks are trading at or near fair value. The S&P 500 now trades at 21.6x 2024’s earnings estimate of $242 compared to the ten-year average of 17.7x. The share price of a company is determined by their earnings per share times the multiple investors will pay for those earnings or the price/earnings ratio. Since the earnings estimate for the S&P is unchanged from the beginning of 2024, the entire first-quarter S&P 500 price increase was from multiple expansion. While this is fine, investors would prefer earnings growth to be the catalyst for higher prices. It is interesting to note that the optimism over interest rate cuts accompanied by an acceleration in economic growth has not found its way to higher earnings estimates.

Artificial Intelligence (AI) is a revolutionary technology that has captivated investors’ attention since ChatGPT launched in November 2022. Early beneficiaries of the AI buildout are often referred to as the “picks and shovels” companies. These businesses provide the foundation and infrastructure needed for the development and deployment of AI. Key companies that have participated and benefited from this AI buildout include the cloud computing service providers (Microsoft, Google, Amazon) and semiconductor providers (Nvidia, AMD, Micron, SK Hynix). One area that will benefit from the massive data center buildouts to run AI systems but has escaped notice until recently are independent power providers and electrical grid infrastructure companies. Data centers require massive amounts of electricity. Accounting for 2.5% of power demand today, data centers could consume 7.5% by 2030, according to the Boston Consulting Group. Independent power providers (Vistra, Talen, Constellation Energy) are well-positioned to help meet this demand. Electrical grid infrastructure companies (Quanta, Mastec) will enjoy enormous long-term demand for their services as electric utilities invest billions to expand capacity and strengthen and harden the electrical grid. Companies that provide equipment to manufacture semiconductors (Applied Materials, Lam Research, ASML) are also critical to the deployment of AI capabilities.

Fixed Income

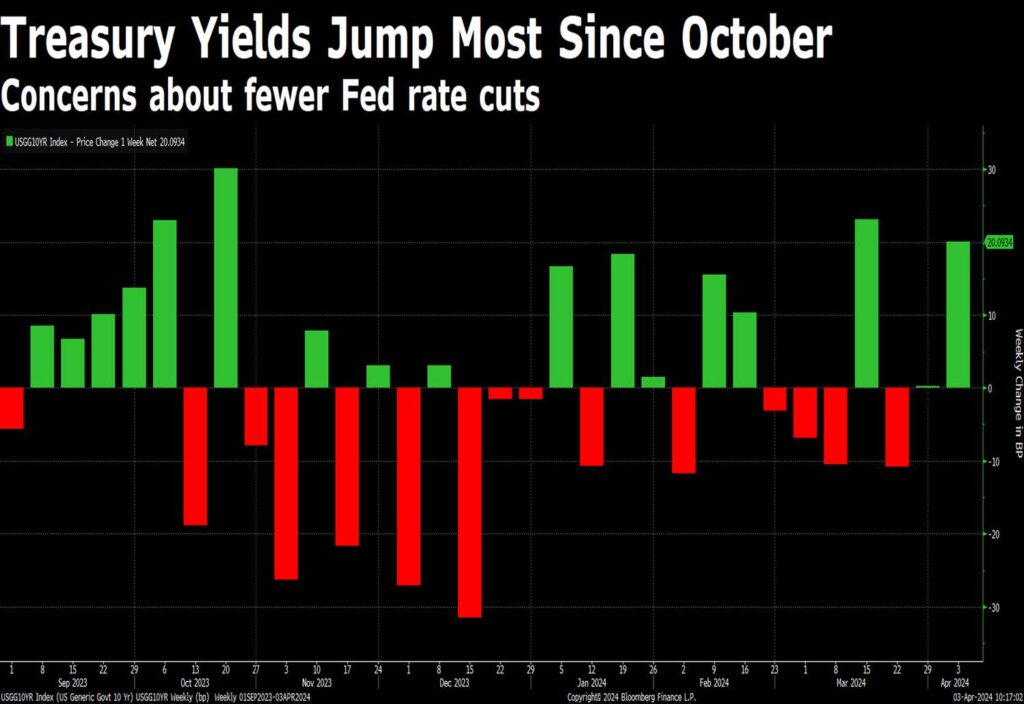

Disappointing inflation readings in January and February have caused an approximate 30 basis point backup in rates across the Treasury curve (from 2-year to 30-year maturities) while the short end remains anchored to the Fed Funds rate. Last year’s 100 basis point rally into year-end was driven by investors expecting 6 to 7 rate cuts but that enthusiasm has been tempered to an expected 2 to 3 cuts as economic data and inflation remain stronger than expected.

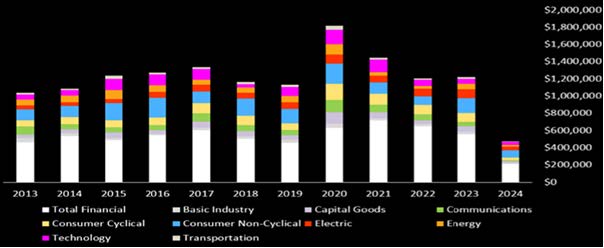

Credit spreads between high-yield and investment grade bonds have reached multi-year tight levels despite the inverted Treasury curve (2-year vs 30-year), continuing to predict economic turmoil sometime in the future. Credit spreads have tightened over 40 basis points from their widest levels in 2023. This tightening of spreads has served as a shadow rate cut for corporate borrowers and has resulted in a record $500B of issuance during the first quarter of 2024. Corporations’ proven ability to tap the credit markets has removed the worry of a maturity wall hitting in 2025 that could cause volatility in the credit markets.

The municipal market is trading at multi-year low ratios to Treasuries. While corporate investment grade credit is experiencing record issuance, the municipal market is seeing a slowdown in issuance across the country as most issuers took advantage of low rates in 2020 and 2021. While municipal issuance has waned, demand has only increased since the beginning of the year as investors look to lock in current yield levels at multi-year highs despite their low ratios. Another driver of demand for municipals has been the possibility of federal tax rate hikes in the future to help manage future budget deficits, record Treasury issuance and increased cost of servicing the debt.

Summary

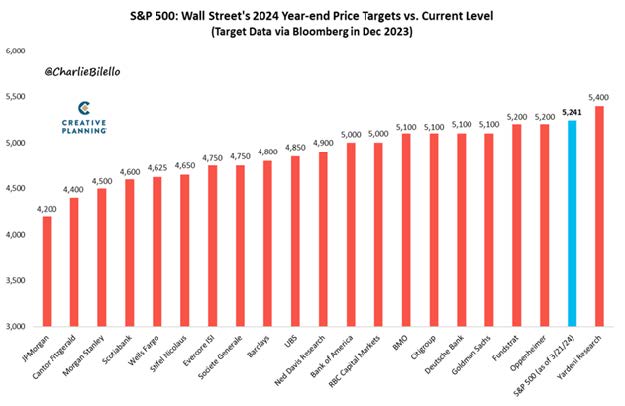

The S&P 500 was up 10.6% in the first quarter of 2024 and shows the market can still perform well amid considerable uncertainty. With the S&P now trading at 21.6x this year’s earnings estimate, we believe the index is fairly priced. The most recent economic data suggests the economy was stronger than expected. The ISM manufacturing index registered 50.3%, indicating that the U.S. manufacturing sector is growing (above 50 U.S. manufacturing sector is expanding, below 50 is contraction) for the first time since 2022. Manufacturers also reported that March materials prices rose for the third month in a row. This implies less of a need for rate cuts and has resulted in a pickup in market volatility. From experience, we know that in periods of high volatility, asset prices can deviate significantly from their intrinsic values. Guyasuta Investment Advisors will remain disciplined and stay focused to capitalize on opportunities that arise during periods of heightened uncertainty.

The Magnificent 7 year-to-date

Historical snapshot of S&P 500 market vs equal weighted performance

With the S&P 500 above 5,200, only one Wall Street firm has a higher year-end price target

The tech revolution and electricity demand

While inflation data may be moderating, CPI is still well-above the 2% long-term trend

The most likely long-term solution is higher taxes and lower federal spending

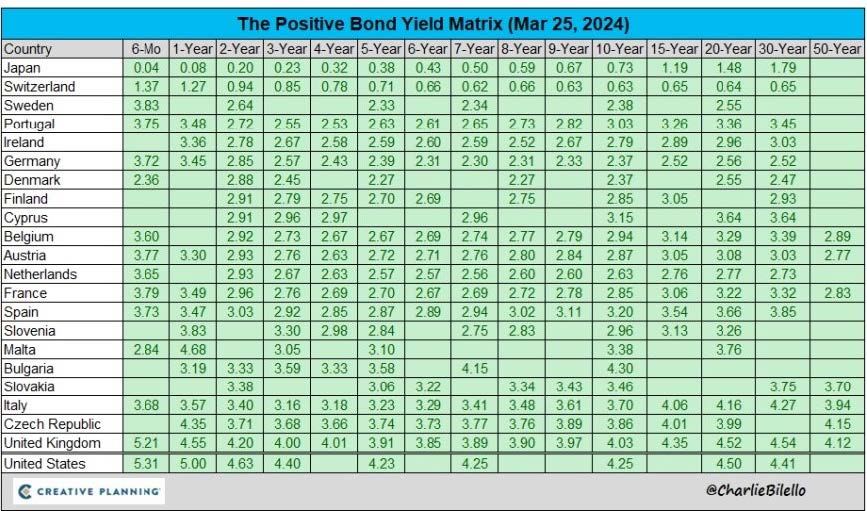

Treasury yields

Corporate bond issuance

In May 2020, 21 countries had negative interest rates vs 0 today