First Quarter 2025

Quarterly Comments March 31, 2025

Summary

The arrival of a new Presidential administration in January initially brought optimism to equity markets as investors anticipated tax cuts and a business-friendly, deregulatory agenda. That optimism faded in February as the new administration focused on government downsizing, tariffs and negotiating a settlement of the Russia/Ukraine war. As a result, we observed a round of government employee layoffs, funding cuts and the launch of an escalating trade war, all of which brought fear and uncertainty to investment markets. In the quarter, equity markets declined, with the main indices entering correction territory (-10% off peak), while fixed income posted positive returns as sentiment shifted to lower-risk income generation. In this edition of the Market Comments, we analyze the impacts that policy uncertainty and inflation are having on the economy, consumer, and investment markets.

The economy: consumer sentiment, business activity, GDP growth

Macroeconomic indicators were mixed in the quarter with recent data showing softness in business activity and consumer sentiment. Consumer spending is top of mind for investors as it makes up ~70% of total GDP. Despite ongoing low U.S. unemployment of ~4%, and above-average wage growth, consumer sentiment sharply declined in the quarter as individuals began digesting the potential inflationary impact from tariffs and the effects of layoffs implemented by the Department of Government Efficiency. Despite progress, inflation remains elevated relative to the Fed’s 2% goal and consumers continue to feel the impact from overall higher prices. Also weighing on consumers is an ongoing shortage of affordable housing. Most outstanding mortgages are locked in at rates that are approximately half the current 30-year fixed national average of 6.7%. This dynamic restricts the inventory of homes for sale and drives up prices. As a result, the lower-end consumer remains under pressure. Higher end consumers have been somewhat insulated from inflation and housing market pressures as gains in their investment portfolios and homes offset price pressures. We continue to observe a bifurcation in consumer spending dynamics as the top 10% of earners now make up almost half of overall U.S. consumer spending, which is elevated by historical standards. We believe that the concentration of consumer spending at the higher end, and that spending’s dependence on asset price appreciation implies that the consumer, and thus overall economic growth, is particularly sensitive to market volatility at the moment.

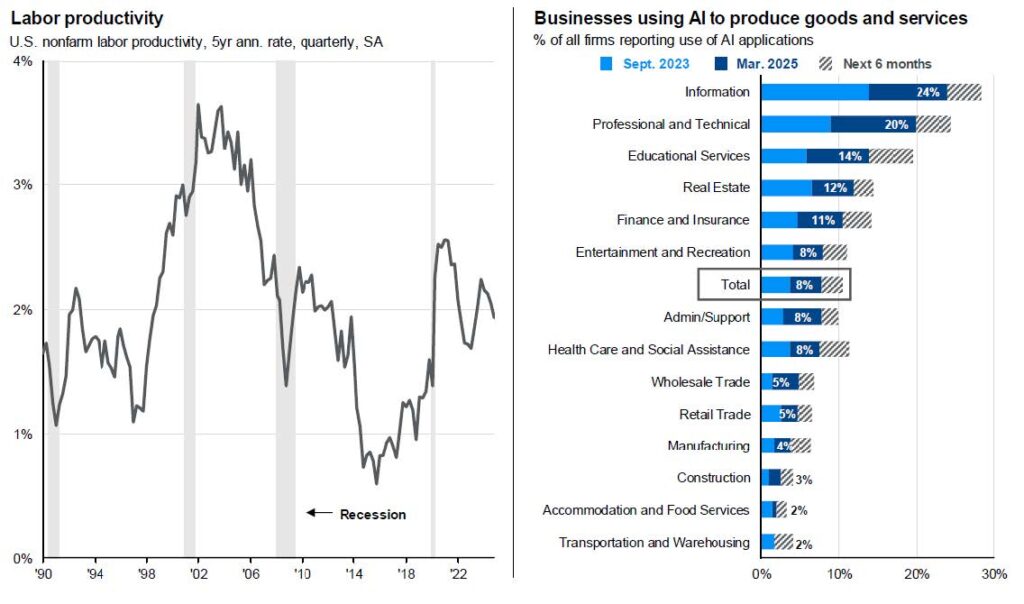

On the business side, the recent Purchasing Manager’s Index (PMI) print at the end of March fell to 49.8, down from 52.7 previously. PMI is often viewed as a leading indicator of the direction of the economy, and despite strength in the service sector, a PMI of less than 50 would indicate a contraction in the manufacturing sector. Given the slowdown in manufacturing and reduction in consumer spending, U.S. GDP growth is expected to slow for the remainder of 2025 with consensus forecasts currently at 1.7% versus the previous forecast of 2.1%. With potentially sticky and higher inflation combined with weaker expected economic growth, risks of a stagflationary environment are rising. While we have not experienced significant stagflation since the 1970’s, investment returns for that period, when adjusted for inflation, were flat to negative. Uncertainty, in itself, canbecome a drag on the economy as consumers and businesses spend and invest more conservatively at the margin. Against the backdrop of elevated policy uncertainty, and accompanying market volatility, we remain focused on following our data-driven investment processes.

Equities: briefly entered correction territory

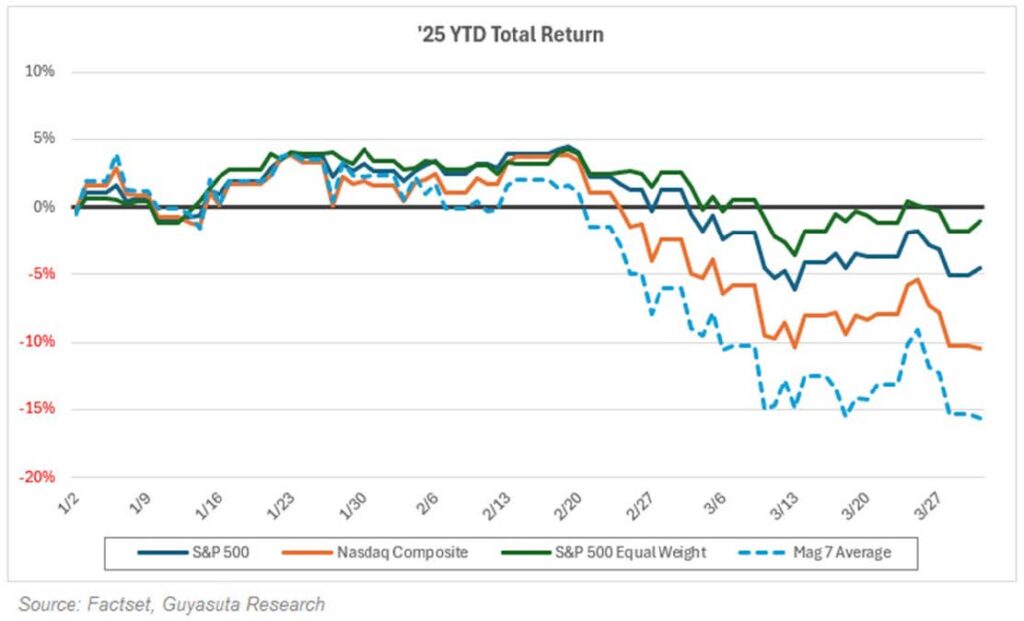

Equity markets sold off in the first quarter as investors reacted to ongoing policy uncertainty, geopolitical tension, and the impact that tariffs might have on inflation and future economic growth. The S&P 500, S&P 500 Equal-Weight, and Nasdaq Composite all posted negative returns for the quarter of -4.3%, -0.6%, and

-10.2%, respectively. The growth-heavy and AI-exposed Nasdaq index was hit harder as investors questioned the underlying valuation premiums while also digesting the risks that DeepSeek’s alleged AI model efficiencies might have on longer-term growth. While the S&P 500 is down year-to-date, its forward P/E valuation has remained flat versus the end of last quarter as consensus estimates for forward earnings were revised downwards. As a result, the S&P 500 is trading at a premium as compared to its equal-weighted counterpart, primarily because of the lofty valuations and weightings of the Magnificent 7 cohort.

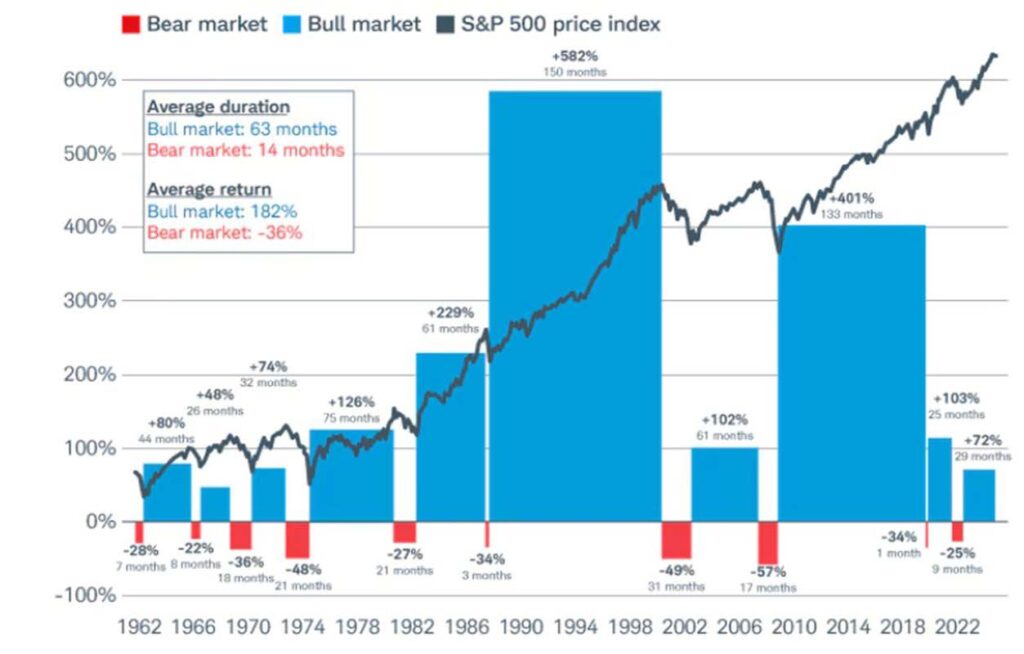

Equity markets bottomed for the quarter in mid-March as the new administration publicly noted that near-term economic pain may have to be endured to achieve the goals of an escalating trade war. As a result, several equity indices entered correction territory and gave back their pre-election gains from November. While the S&P 500’s -10% drawdown was the 5th fastest in the past 75 years at ~20 days long, it is important to remember that drawdowns of -10% or less are common in the S&P 500 and have occurred in 58 of the last 97 calendar years (or about 60% of the time). Equity markets have since received some reprieve, with the S&P 500 rebounding ~+2% off of the March 13th bottom. While the future direction of equity markets is unknown, it’s worth noting that drawdowns of -20% or more are infrequent and have occurred in only six of the last 27 market corrections since 1974.

Despite this quarter’s soft equity market performance, Q4 earnings reports came in strong with the S&P 500 growing earnings on the quarter and the year. However, forward guidance was much more cautious and conservative in most cases as corporate managers try to navigate the same uncertain macroeconomic backdrop that is challenging equity investors and consumers. The majority of guidance we observed this quarter was without tariff considerations given difficulties in quantifying the impact without actual clarity on the details. We will be closely monitoring this next quarter’s earnings releases and tracking guidance revisions as we believe this will be a pivotal quarter in determining the financial impact from tariffs set to start on April 2nd.

Against this backdrop, we continue to execute on our proven investment philosophy of finding quality, growing companies that are trading at contextually reasonable valuations. We favor companies with strong balance sheets, competitive moats, and recurring, steady cash flows as these characteristics help preserve capital during market drawdowns. Quality, cyclical business models can also offer this profile but with a more compelling valuation and better ability to participate in up-trending markets. We continue to assess the risks that policy and tariffs have on our investment holdings and note that the countries being targeted most (China, Canada, and Mexico) comprise only 9% of our Core portfolio’s revenue.

Fixed Income: benefitting from risk-off rotation

On the back of a declining equity market, fixed income helped diversify portfolios with key indices posting positive results on the quarter. Investment Grade and High Yield Corporate indices returned +2.1% and +1.2%, respectively, in the quarter. Positive returns reflected falling yields, which accelerated when equity markets peaked in mid-February, and investors sold equities in favor of bonds. Fixed income investors bought into 2-year and longer maturities, where we observed the three-year Treasury yield declining by ~26bps in a little over a month’s time. This signals an incremental risk-off rotation as investors navigate the unknown future impact of policy uncertainty.

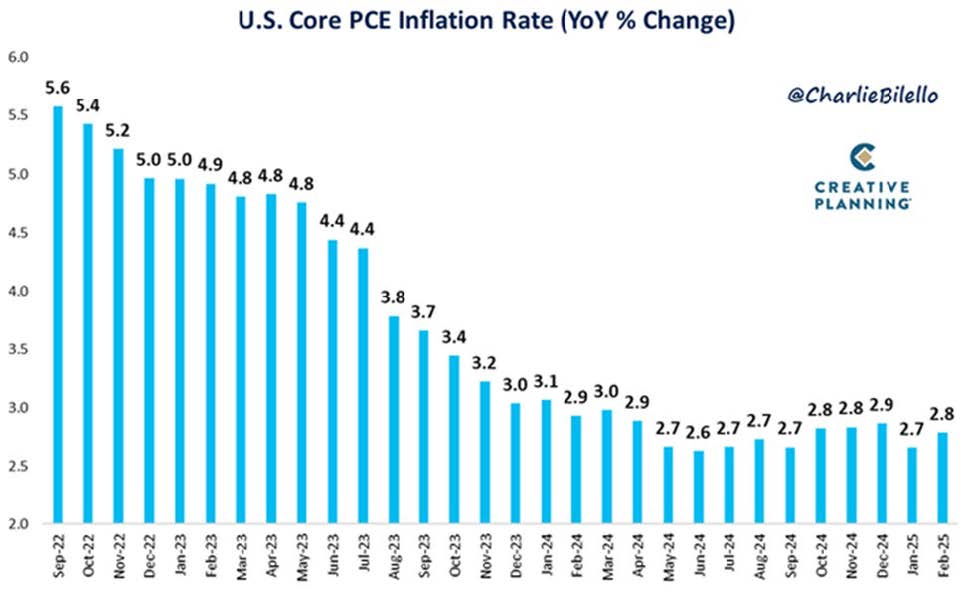

Treasury yields on maturities of 6 months or less remained flat this quarter as the Fed took a cautious approach to policy given mixed economic data and uncertainty around the impacts of new tariffs. At its January and March meetings, the Fed held rates steady while reiterating its data-dependent approach to achieve the long-term goal of getting inflation back to its 2% target. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures Index (PCE) currently stands at 2.5%. The Fed also noted a reduction to its GDP growth forecast, which follows other developed nations’ expectations of a similar slowdown. As a result of this quarter’s Fed commentary, Fed funds futures suggest at least two more rate cuts by year-end, more than anticipated at the start of the year. This reflects investors’ perception that slower than anticipated economic growth and ongoing progress on inflation will lead to modest interest rate cuts from the Fed.

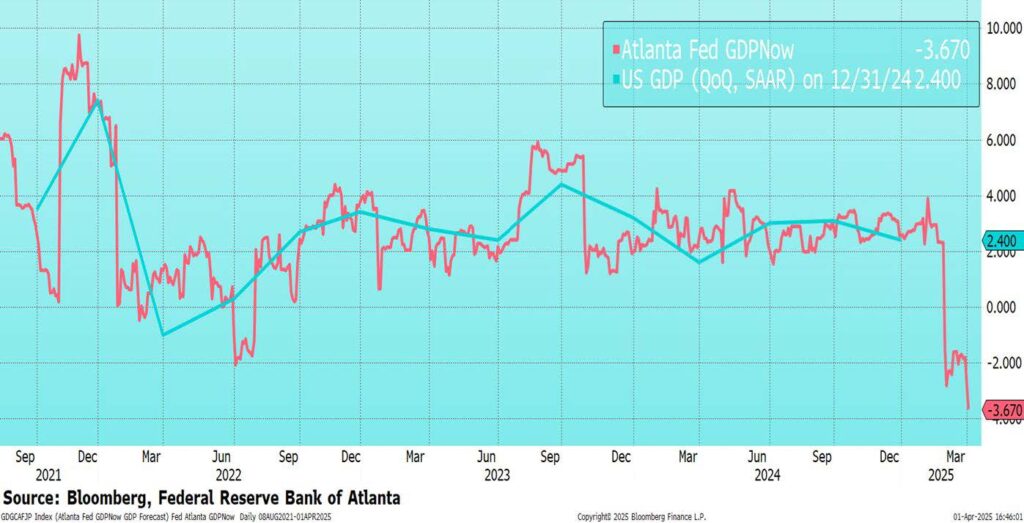

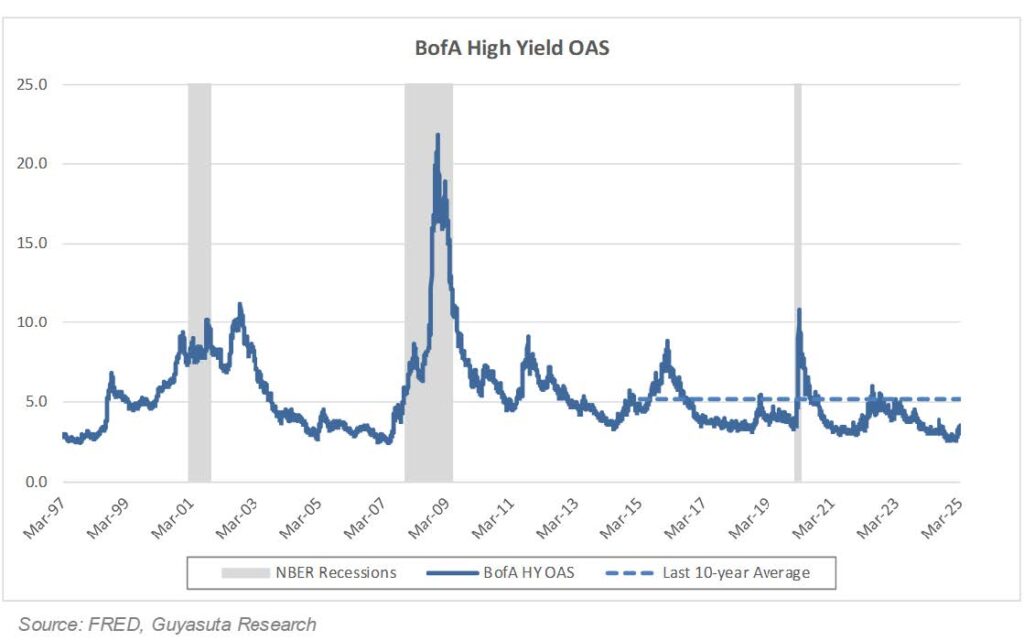

While equity markets were more worried about near term risks this quarter, fixed income markets showed a bit more optimism as corporate bond spreads continue to trade near historic lows, corporate default risk remains low, and overall systematic leverage is healthy. Though corporate spreads remain historically tight, we did observe some incremental widening this quarter. The magnitude of widening is not yet a red flag, but we are continuing to monitor this indicator given equity market volatility. Also on our radar is the Atlanta Fed’s GDPNow forecast, which is an estimate of future GDP growth based on the ongoing publication of componentry data. At the beginning of March, we saw this estimate move sharply lower to nearly a -3% contraction. It’s worth noting that one-time idiosyncratic contributions can skew the GDPNow forecast to an absolute error of upwards of 4.0%, which is what we observed with 2020 forecasts.

Despite the wider margin of error possible with the GDPNow forecast, we are continuing to watch its estimates given the signaling indicated by recent trends of the U.S. Treasury curve. We experienced a significant level of yield curve inversion in 2023 and 2024 in the wake of the Fed’s rate hiking campaign to fight inflation. Most maturity pairs dis-inverted late last year and we are now off-peak inversion levels. Historically, dis-inversion has resulted in a meaningful economic contraction in the 6 to 24 months that follow. These recent yield curve trends alongside a GDPNow contractionary forecast suggest a heightened risk of an actual economic downturn. As a result, our team is proceeding with caution and maintaining our laddered bond approach with a duration of 5-6 years to capture higher yields while limiting term risk due to the longer-term uncertainties of Fed policy, economic growth, and potentially stickier inflation.

Conclusion: remain cautious and ready

The new Presidential administration’s agenda brought a great deal of uncertainty to markets and consumers in the first quarter of 2025. The heightened market volatility this quarter was driven by speculation of the potential financial impact of these policies rather than solid evidence. With a wide range of potential economic outcomes from here (growth but slow, stagflation, or recession), we believe a cautious stance is warranted until there is firmer evidence on the direction of the economy. We are here to help our clients navigate this complex market. If you have any questions or concerns, please do not hesitate to reach out to us.

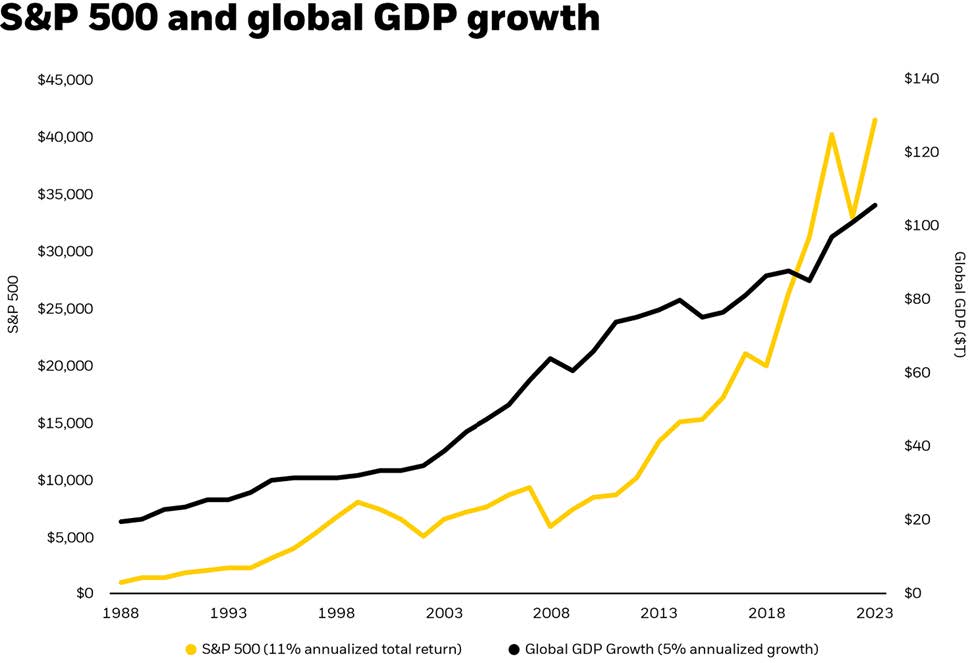

Market expansion has coincided with globalization, technology innovation and higher company operating margins

Magnificent 7 and AI beneficiaries sold off more given higher valuations and headline risk

Tariffs on U.S. imports

A potential negative economic indicator

However high yield spreads not signaling a weak economy

Productivity improvements can help mitigate inflation

Bear markets have been shorter than bull markets